The Belize company formation process is a quick and easy one and can be accomplished in just a matter of one to two days. Moreover, the extremely advantageous taxation principles in this jurisdiction attract a significant number of investors. A part of the incorporation process refers to the corporate bank account; our team can help you open a bank account in Belize.

Belize is one of the most popular international locations for offshore companies. The country is a diverse one and its culture reflects its many influences and historic heritage. The population is multilingual and English is the official language, making the country an ideal place to base an international business.

| Quick Facts | |

|---|---|

| Types of companies |

The International Business Company (IBC) |

|

Minimum share capital |

There is no minimum capital requirement |

|

Minimum number of |

1 |

| Time frame for the incorporation |

24 hours |

| Corporate tax rate | The IBC is not subject to corporate income tax |

| Dividend tax rate |

N/A |

| VAT Rate |

N/A |

| Number of Double Taxation Treaties (approx.) | 4 |

| Do you supply a Registered Address/Virtual Office? | Yes |

| Local Director Required | The IBC director does not need to maintain a local director. |

| Annual Meeting Required | The company may choose to schedule such a meeting as needed (and not necessarily in Belize). |

| Redomiciliation Permitted | Yes |

| Electronic Signature | Yes |

| Is Accounting/Annual Return Required? | The IBC submits an Annual Business Tax Form (our team can give you details). |

| Foreign-Ownership Allowed | Yes |

| Any Tax Exemptions Available? | N/A |

| Any Tax Incentives? | The Belize IBC is fully exempt from paying any taxes in Belize. |

| Nationality restrictions for investors in Belize | None applicable. |

|

Must travel to Belize for company formation |

You can discuss your options for using a power of attorney for company incorporation with the help of our team. |

|

Company shareholders need to reside in Belize |

This is not a requirement. |

| Company directors need to reside in Belize | No requirement for resident or national directors. |

| Belize IBC can hire foreign employees |

The IBC can hire foreign employees. |

| Virtual office option |

Upon request, as a separate package, for those companies that may take advantage of this type of setup. |

| Licenses for financial activities |

Required for activities such as brokerage, consultancy, international money exchange services, and others. |

| Financial license issuing authority |

The Financial Services Commission (FSC) |

| Licenses for other activities |

Please reach out to our team for a complete list of regulated activities in Belize. |

| Third-party license application | Possible through a power of attorney; subject to conditions and the provision of certain documents for application. |

| Alternatives to the IBC |

The limited liability company (LLC) |

| LLC characteristics |

The international LLC offers advantages in terms of limited liability, as well as tax exemptions. Restrictions on doing business in Belize (onshore activities) can apply. |

| Company formation in Belize advantages |

Easy company formation, tax exemption for the IBC, no residency requirements, a high degree of privacy for foreign investors, etc. |

| Reasons to work with us |

We are an experienced team who has worked with foreign investors from many different countries. |

| When to contact our team | As soon as you are interested in setting up an IBC in Belize. |

Reasons for opening an offshore company in Belize

You can open an offshore company in Belize for the following activities:

- international businesses and trading;

- e-commerce;

- movable and immovable property custody;

- intellectual property management;

- inheritance purposes.

The International Business Companies Act and the Offshore Banking Act govern thecompany formation process in this jurisdiction. A few requirements and restrictions are in place, such as the fact that the International Business Company (IBC) – the offshore business entity type – can only be used for international investment and business activities and not for primary trading with Belize companies. Moreover, the IBC cannot own real estate in Belize. One of our Belize offshore company formation agents can give you more details on these characteristics. In case you would like to start an offshore company in another jurisdiction and your need specialized assistance, our partners who are experts in offshore company formation procedures can help you.

Foreign entrepreneurs who open an IBC in Belize have the following advantages:

- no taxes: the Belize International Business Company is not subject to taxes or duty on profits and the same applies to stamp duties.

- no minimum paid-up capital: there are no mandatory requirements for the paid-up capital of an IBC although a minimum amount is recommended.

- just one director and one shareholder: the incorporation requirements are very low and the company can be formed with just one shareholder and one director who can be one and the same person.

- fast and easy bank account set up: opening a bank account in Belize is a simple process and also a fast one.

- complete privacy with nominee directors: investors who wish to enjoy the highest degree of confidentiality possible can use nominee director and shareholder services in Belize.

- guaranteed confidentiality and financial privacy: Belize is a jurisdiction that values the privacy of the foreign investors and no disclosures are needed when forming a company.

Our team of Belize company formation experts describes these advantages in more detail below. Apart from offering a tax-free regime for local companies, another important advantage for many international investors is that English remains the official language, although several others are also common. This allows for an international business environment.

No taxes

The top reason why Belize is considered a tax haven is that offshore companies incorporated here do not pay taxes on the income they derive from abroad. Moreover, dividend payments made by offshore companies in Belize to non-Belize citizens are also tax exempt. This tax-free business environment determined many foreign investors to open a company in Belize.

Nevertheless, investors should know that Belize enforces the global standards for anti-money laundering as well as those for fair taxation. For this purpose, an Economic Substance Act was enacted in 2019 and the legal entities that fall under its scope are those companies incorporated under the International Business Companies Act as well as those licensed under the International Financial Services Commission Act. One of our agents can provide more details.

No capital requirements

There are no specific requirements on the paid-up capital of the offshore company. The share capital may be deposited in any currency and there are minimum government fees upon the incorporation of a new Belize offshore company.

Just one company director

A Belize International Business Company can be incorporated with just one director and one shareholder and there are no requirements for a local secretary. The company director and shareholder can be one and the same person. Another recommendation is to include a registered agent service.

Easy bank account set up

Your offshore company in Belize will need a bank account, in most cases complete with e-banking services. Our Belize company formation agents can help you open this account.

Minimal accounting requirements

Companies in Belize must keep their accounting records at their registered office or with their registered agent. However, there are no requirements for annual filing and auditing. The Accounting Records Maintenance Act applies to International Business Companies, protected cell companies, foundations and mutual funds in Belize as well as companies registered under the Companies Act (overseas companies also included). All companies are required to keep the accounting records in such a manner in which they can be easily accessed and ready when or if information exchange requests take place. Companies also need to facilitate access in case of criminal investigations and comply with the laws and regulations that apply in such a case. Moreover, the accounts are to be maintained for no less than five years (from the closure of an account, from the date of a transaction, the termination of a business relationship, etc.).

The competent authority in matters concerning the Accounting Records Maintenance is the Ministry of Finance. One of our agents who specialize in Belize company formation can provide investors with more details on the accounting requirements. If you need assistance for registering a business in Mauritius, we recommend our reliable local partners from CompanyFormationMauritius.com.

Nominee directors in Belize

Belize has a high degree of investor privacy protection and there are no public records for companies. Nevertheless, investors who wish to have full anonymity can request our nominee director services, provided by our team of Belize company registration agents. We can provide both nominee director and nominee shareholder services if you wish to open an offshore company in this country.

We invite you to watch the following video about the creation of an offshore company in Belize:

Guaranteed confidentiality

Belize deserves its reputation as an international offshore company jurisdiction because of its laws concerning investor confidentiality and financial privacy. The country imposes certain laws that prohibit the disclosure of bank account information, the disclosure being possible only in the event of criminal investigations and if a court order is issued. Moreover, investors benefit from an even greater degree of bank account confidentiality, as there are no exchange control policies and no restrictions on currency movements in/out of the country.

Theoffshore company is required to have a registered office, however, this does not mean that you will need to be present at this location. One of our Belize company formation agents can help you observe the requirements for having a locally registered office for your offshore company. In case you are considering starting an offshore company in another jurisdiction than Belize, we can put you in contact with our partners from www.companyincorporationpanama.com.

The IBC in Belize

The Belize International Business Company is the business structure incorporated by offshore investors, used for international business purposes. The particularities of the legal entity type are described in the International Business Companies Act of the Laws of Belize. The laws for company incorporation are attractive because of the fact that they meet the needs of international investors and the creation of the IBC as a business entity type was an important step in transforming Belize into one of the top offshore centers in the world.

The requirements for this type of company are very flexible, another key point of interest to foreign investors. The name can be in English but it does not have to be limited to one language as non-English names are permitted. The shares can be denominated into any currency and, most importantly, as already stated, this business entity is tax-free.

The IBC in Belize is incorporated in just one day when all of the documents are in order. One of our Belize company formation agents can help you during the registration so that the entire process can run a smooth course. Businessmen who need company formation services in other countries, for example in Switzerland, can receive specialized assistance from our partners – CompanyFormationSwitzerland.com.

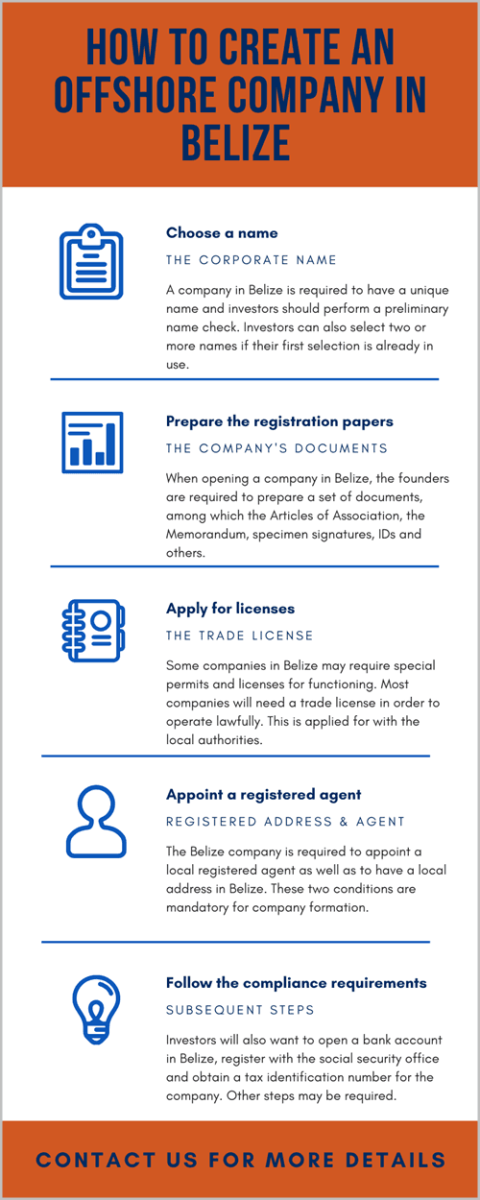

The following steps need to be completed in order to open an International Business Company in Belize:

- The name: the name of the company should be unique and will include the abbreviation of the business form.

- Information about the directors: the company directors and shareholders must provide a set of identification documents (the information is not disclosed publicly).

- Fill in the incorporation form: contains information about the name of the company, the authorized capital and a specific description of the nature of the company activities.

IBC licensing presented by our Belize company formation agents

The Belize IBC can be used for a variety of international business purposes, specific or general ones. A situation in which a Belize company is required to obtain a license is for Forex trading activities. Companies that are applying for a license for the first time can expect the processing time to be around 10 working days following the receipt of the complete documentation required for the license. In addition to this, the license may take another 5 to 10 working days to be issued, because of the fact that the Commission is to verify the payment of the due fees. Companies that apply for licenses with the International Financial Services Commission are subject to a due diligence process.

Some of the types of licenses are the following:

- Opening or managing international business companies or other offshore companies;

- Opening trusts or managing offshore trusts, providing trustee services;

- International asset management and protection;

- Payment processing services and money transmission services;

- Forex trading;

- Money brokering, money exchange, money lending;

- Trading in financial and/or commodity-based derivative instruments as well as other securities;

- Safe custody services;

- Accounting services;

- Consultancy or advisory services in the areas mentioned above.

Investors who wish to open an offshore company in Belize and provide one or more of these services should know that an application fee applies to each of these types of licenses. Moreover, the license is subject to an annual renewal fee. One of our agents can provide more details on the types of licenses and their fees as well as the general application process.

Doing business in Belize

Investors who make a substantial investment can also qualify for residency in Belize. Our team can give you complete information about the minimum requirements for the investment and, according to your situation, will give you details on the possibility to apply for permanent residence after one year of lawfully staying in the country for business or investment purposes.

Although Belize offers a fast incorporation process, investors may still want to acquire a shelf company. This is an existing and registered legal entity that has not been used for trading or business purposes and thus has a clean record and no debts. In Belize, investors can purchase shelf companies that allow registered bearer shares or companies that do not allow bearer shares.

We recommend that investors explore all of their available options when opening a company in Belize and request assistance for due diligence whenever needed.

Investors who wish to open a company in Belize can read below a number of key 2020 statistics about businesses below:

- 18.3% of the registered businesses in Belize activate in the Wholesale and retail trade sector;

- 15.6% of the registered businesses are in the Accommodation and food service activities sector;

- 14% of the total businesses activate in the Agriculture sector;

- 36.1 % of all the registered businesses reported that they were located in the Belize district, followed by 17.7% in Stann Creek and 14.6% in Orange Walk;

- 12.6% of all the registered business types were Private limited liability companies/registered companies; 69.6% of the registered business forms were Sole Traders (Proprietorships).

The Business Establishment Survey was carried out by the Statistical Institute of Belize (SIB) in 2020 and the data was released in the first quarter of 2021.

According to a different report, issued by the Financial Intelligence Unit in Belize, the largest asset value in the financial sector is held by domestic banks, with international banks and credit unions also amounting to important asset values in 2017. In 2017, domestic banks held assets with a value of 3.1 billion BZ, international banks had assets of 1.1 billion BZ and credit unions had assets of 0.9 billion BZ.

Our partner lawyers in Belize offer complete solutions for investors who are interested in offshore company creation in the country. We specialize in Belize offshore services, such as the creation of International Business Companies, bank accounts, foundations of trusts, but can also help corporate clients with debt collection, employment issues, or intellectual property law, among others.

Belize is a jurisdiction that offers a favorable combination of several important benefits, such as financial privacy, tax neutrality, and easy company formation. While most offshore locations offer a combination thereof, in Belize all of these characteristics combine in order to create a favorable and stable business climate.

If you are interested in immigration to Belize, you can reach out to our team at any stage of your relocation process. Remaining in the country under temporary or permanent residency is subject to a set of conditions and the foreign national needs to meet certain requirements. Applying for the right type of residence permit can be easier with the help of our team so do not hesitate to reach out to us.

You can contact us if you need professional and efficient assistance in order to open an offshore company in Belize or if you want to start doing business in other countries. Investors interested in investing in another jurisdiction, for example in Luxembourg are invited to contact our partners – fiduciaire-luxembourg.com.